Getting yourself insured is the first step toward building your financial future. That’s why we offer customer to Compare Term Plan Online with latest IRDA data so that you can buy the Best Term Plan at the lowest cost.

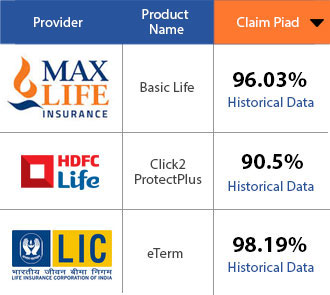

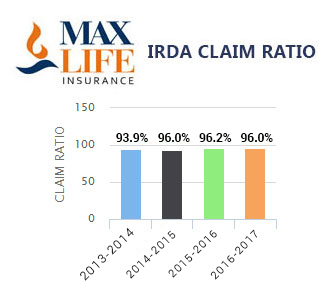

1. Compare Claim Ratios

1. Compare Claim Ratios

Compare claim ratio of various insurance companies based on latest IRDA data.

COMPARE NOW

COMPARE NOW

2. Historical Data

2. Historical Data

Compare and buy online directly from the insurers with click of a button. Easy, fast and convenient!

COMPARE NOW

COMPARE NOW

3. Compare Premium

3. Compare Premium

Compare premiums of various online term insurance policies. Find policies that offer real value for money.

COMPARE NOW

COMPARE NOW

As online term plans have gained popularity, almost all the life

As indicated in my earlier post, IRDA claim settlement ratio might be an

Being in the business of financial advisory, I find many intelligent and